One of the most important tasks in renting a property which needs to be completed is the signing of a legally binding contract between the landlord and tenant. This is known as the “tenancy agreement”, “letting agreement” or “lease”. The objective of the contract is to highlight the rights and responsibilities of all parties – landlord, tenant and letting agent.

As a letting agent or property manager, generating a tenancy agreement is normally quite routine, yet time-consuming. The majority of the tenancy agreement remains the same,with the first couple of pages tailored to that of the property and majority of terms or clauses set in stone according to local law.

Tenancy agreement software

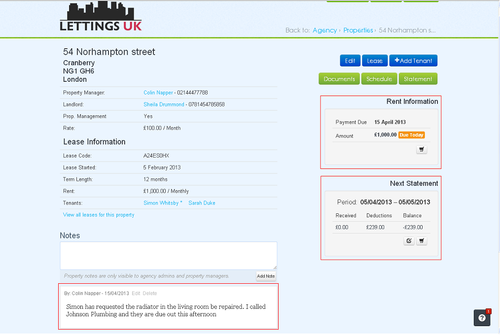

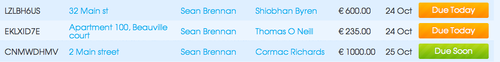

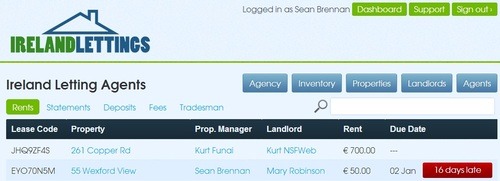

Tenancy agreement software created here; at Rentview we have looked at how to save time for you, the letting agent, by streamlining the whole administration process around the letting of a property. Not only will the auto generation of the tenancy agreement save you time, but now all your documents can be stored securely online. Being cloud-based, your data is backed up every hour on multi-site servers, so your data is kept secure and up to date at all times. The tenancy agreement can be shared online with both landlord and tenant.

Through our letting agency software, each process within the cycle is streamlined to save you time when you arrive at your next task along the cycle. Take a look at the overview video on our tenancy agreement software to see exactly how easy Rentview makes this process.

If at this time you prefer not to use the tenancy agreement software and want to continue generating your own tenancy agreements, that is fine. Below we have provided a link to free blank tenancy agreements.

Tenancy agreement UK – AST Blank lease

Tenancy agreement Scotland – AT5 Blank lease

& Tenant information pack Scotland

Tenancy agreement Ireland – Fixed Term blank residential lease

by Rentview