Property management – How important is good customer service?

Customers are the lifeblood of your business. Without them, your business would more than likely not exist. Due to the fact that they’re so vital, it’s important that they’re retained and don’t take their business elsewhere. One of the best ways to do this is by offering excellent customer service. This is especially important for property managers, as you’re in direct contact with your customers a lot more than many other businesses.

Poor customer service gets talked about. A lot. People are very willing to spread negative stories, whether it is just to their friends, or more dangerously, by posting their experience online. Marketers are waking up to the power of word of mouth, and so should you. It has been proven that negative word of mouth is more common and effective than positive word of mouth, but that’s not to say that positive experiences are ignored entirely. Providing excellent customer service encourages positivity and loyalty to the company, which is exactly what you want. After all, it can cost up to five times more to attract a new customer that it does to retain a current one. In saying that, current/old customers can do some of the job by attracting potential customers through positive word of mouth.

If your customer service is not up to scratch and you don’t know how to begin to improve it, it may be worth your while looking at the customer service life cycle model. Often mentioned in relation to the area of information systems, this model breaks the business/customer relationship down into a number of stages. Identifying these stages is a good starting point as it will be easier to pick out areas that need improvement and what priority they should get. Doing this may be a bit time-consuming, so in the meantime there are some basic guidelines you can follow to improve your customer service.

Customer service in property management

Build rapport with your customer – it doesn’t matter whether it’s a landlord or a tenant; you need to connect with your customers. For first time customers, simple things like introducing yourself, engaging in a little bit of small talk and asking how you can help them all work towards building a lasting relationship. Don’t forget your manners and do show genuine interest in the customer by listening and taking notes if necessary.

If you’re dealing with a landlord/tenant when another one appears needing your attention, politely ask them to wait a few minutes and offer them a tea or coffee.

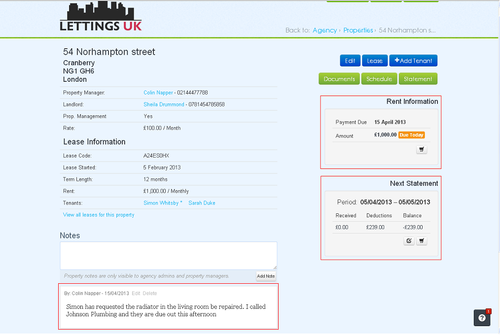

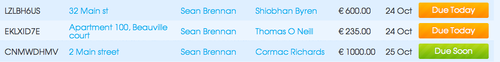

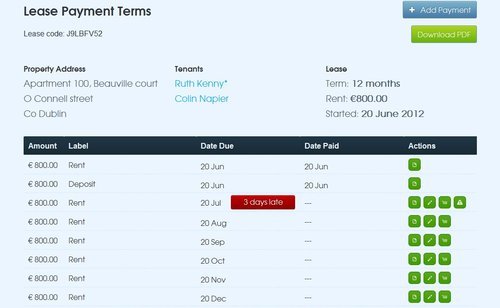

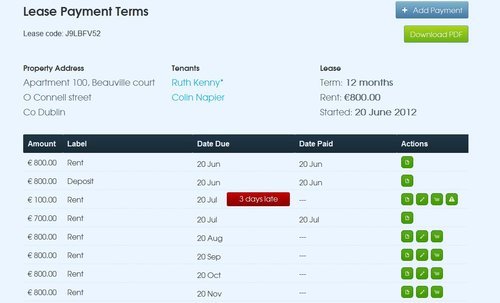

Deal with problems immediately, as much as is possible. Complaints mean unhappy customers and unhappy customers leave very quickly. If a rent is late, keep chasing it and reassure the landlord that they’ll get it soon.

Keep your promises. If you say you’ll get an electricity account switched over by the end of the day, make sure you do.

Finally, go that little bit further for the customer. Even if it’s not fully part of your job, doing something small like offering advice will make customers feel that you truly care and increases the chances of the customer engaging in positive word of mouth.

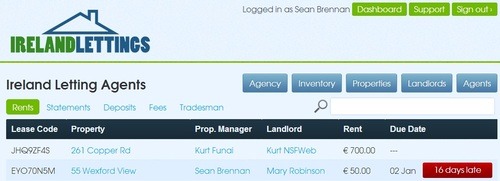

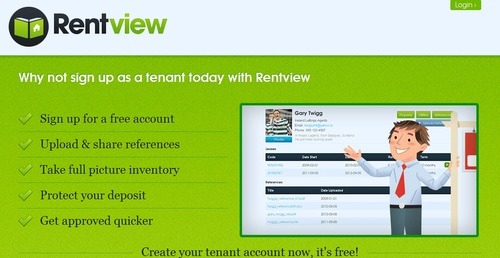

There is letting agency software available that will help you provide greater customer service, why not research the area and see what fits your needs?

Please feel free to comment and share!

Thanks for reading!

by Andreas Riha