Tenants Fees

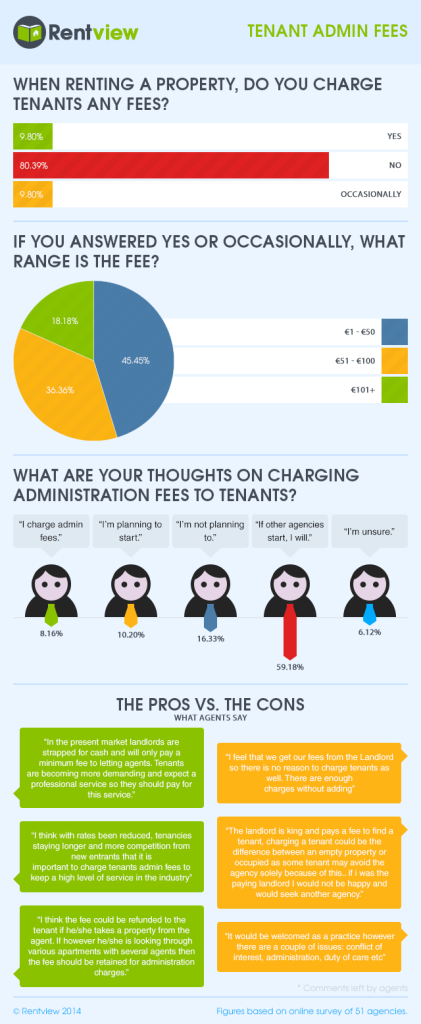

Do you charge your tenants fees or administration fees? That is the question I asked letting agents across Ireland over the last couple of weeks.

So why did I ask it?

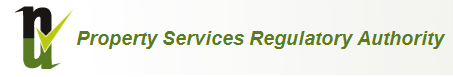

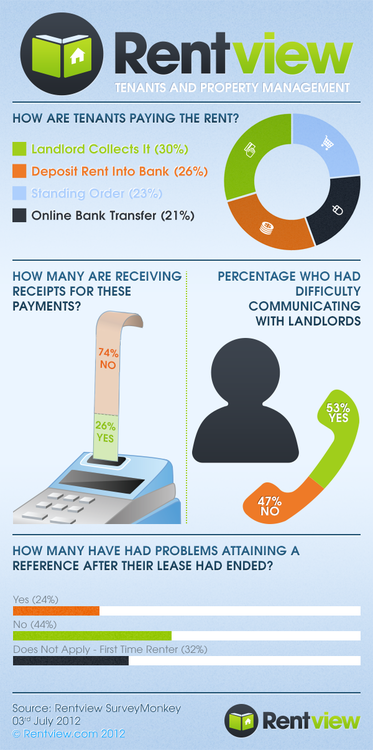

With the rental industry seeing huge demand at the moment most letting agents cannot get enough properties to let out. Most letting agents I’m speaking with on a daily basis are seeing increased costs in running their letting agency both legally and professionally. So with a reduced amount of vacant rental stock to let and increased overheads some letting agents are starting to struggle financially.

Letting Agents Survey Results-

Is it Legal to charge tenants fees in Ireland?

Well if you look at Section 90 of the Property Services (Regulation) Act 2011 it is not-

90.—(1) Subject to subsection (2), any provision (whether express

or implied) in an agreement in respect of the sale or letting of land

whereby the purchaser or tenant, as the case may be, is required to

pay or otherwise bear the cost of the licensee’s fees or expenses in

respect of the sale or letting, as the case may be, shall be void, and

any moneys paid pursuant to such a provision shall be recoverable

as a simple contract debt in a court of competent jurisdiction.

(2) Nothing in subsection (1) shall affect the liability of a person

to pay fees or expenses to a licensee in respect of the acquisition of

any land where the licensee has been retained by the person to

acquire such land and does not also act, in respect of such acquisition,

on behalf of the person from whom the land is acquired.

So from reading the relevant sections in the Property Services (Regulation) Act 2011 charging a tenant an administration fee would be illegal.

Prospects not Tenants

It however does not state if charging a potential tenant would be illegal i.e a person who views a property but fails to proceed into a lease.

A PSR representative quotes “As you may know, the interpretation of the law is a matter for the Courts. I am not aware of any Court action in relation to alleged contraventions of section 90 of the Act so cannot give you references to same. Section 90 refers to tenants (not prospective tenants) and it would be a matter for the Courts to interpret if prospective tenants should have the same rights.”

Charging tenants to view a property

You currently show potential tenants a lot of property with only a small percentage converting into becoming a tenant. Depending on your location some tenants may only view one property with you, so why would a tenant pay to view a property? Unless they are desperate I cannot see this ever happening and would see it as a disastrous business decision.

Receiving an Offer

This is an area where I personally feel along with other agents that there is the ability to charge an administration fee. This is how it works in other markets such as in the UK. If at any stage the tenant pulls out or has given misleading or false information about his/her references that the administration fee is charged. However if the tenant proceeds to sign a lease the fee be refunded in full.

Agent’s comments on this

“I think the fee could be refunded to the tenant if he/she takes a property from the agent. If however he/she is looking through various apartments with several agents then the fee should be retained for administration charges”

“In some respects it is a business crime not to charge tenants fees, especially if they walk away for he deal before signing, as can happen. Absolutely the norm in the UK for the tenants to be charged admin/credit check fees. Also very interesting that many tenants coming into Dublin from overseas expect they will be charged? I’m asked the question regularly! Would love to see it become standard industry practice.”

Charging Prospects

There is also the argument that by charging a tenant you are double charging the landlord.

Agent’s comments on this

“The landlord is king and pays a fee to find a tenant, charging a tenant could be the difference between an empty property or an occupied property as some tenant may avoid the agency solely because of this if I was the paying landlord I would not be happy and would seek another agency.”

“I feel that we get our fees from the Landlord so there is no reason to charge tenants as well. There are enough charges without adding“

Mid lease expenses

When managing some properties having fees in place will help with the overall costs associated with managing the property. These fees can be avoided however for example where a tenant consistently lodges rent in cash into an office or bank then a charge is incurred. Most banks charge approx .5% on all cash deposits so for the average agent this is 10% of your fee gone on bank charges.

Agent’s comments on this

“The reason we started was because Bank Charges are crazy and tenants even though they are asked to never transfer the funds but bring in the deposits/rents into office. This is causing higher bank charges and we have passed it on as we cannot afford to carry this cost. It is a small cost €30 for them to bare and to this date we have never received a negative comment.”

Check out these blogs on rent collection “costs of lodging rents” & “How to collect rent”

“I do have in my lease a 300.00 charge held from the deposit should the tenant break their lease which is very effective. It covers re letting costs as well as PRTB charge etc.”

Membership Fees

Even though the wording of the act states that you cannot pass on any fees to tenants some agencies charge fees. These agents call these fees “membership fees”

Agents Comments on this

“We charge this for each tenancy and at the renewal stages also now. It is an administration charge or a membership charge as such. This is only charged to residential tenants. These charges pay for reference checks, changing utilities, bank fees etc all the way to providing a character reference at the end of the tenancy.”

The Results

Well its clear to see there is a huge appetite from agents to start to charge tenants fees. 69% of letting agents who answered this survey are either planning to or willing to if other agents start to charge.

Analysis

So by charging prospective tenants at any point prior to them actually becoming a tenant is from my understanding the only way to work inside the act. Charging tenants for optional expenses incurred though out the lease term once highlighted within the lease may be the only other option as highlighted with banking fees above.

I am only opening the debate on whether letting agents should charge a fee or not, I am not in a position to legally advise any letting agent. If you are looking to increase your revenue but not looking to charge tenants fees here is a list of 30 free ways to market to landlords

Your Thoughts

What is your thoughts on tenants fees in Ireland. Are you a letting agent, landlord or a tenant who would like to share your opinion and open a discussion on this important subject.