Choosing the right tenant

As an experienced property manager the most frustrating part of the job is chasing the continuously late-paying tenants. If you’re a property manager with a portfolio of property, a landlord with a portfolio or even a landlord of just one property, you will have had to deal with this problem, most likely.

The continuous calls which get unanswered, texts that don’t get replied, emails with ‘send receipt’ not accepted or letters not getting a response the majority of you will have experienced this.

There is just nothing more frustrating, but can we as property managers eliminate this? Well in most cases we can try our best to eliminate this stress as much as possible by choosing the right tenant.

To prevent late payments:

– In what ever lease you are using, if not already in the lease, place a late penalty clause. When going through the lease prior to signing with your tenant(s) make it clear that this will be enforced. Add a clause that for every day late the penalty will be 20 euro. This way at least if it’s late, you’re getting compensated and in today’s climate late rent could cause you or your client to have bank charges with unpaid direct debits or standing orders.

– Reference check your tenants; make sure you get legitimate references. If the reference is from an agency don’t just take it as gospel. Call up the agency and confirm it if it’s from a private landlord and if they only have a mobile number, ask the referee if is it possible to call them on a land line. Any tenant can give you a reference written from a friend with a mobile number on it but they won’t be as quick to give a land line on it. Most landlords will gladly back up the reference with a land line – after all they are in the same position as you.

– But what if they won’t? It can happen. Why not Google their mobile number, more than likely if it’s a mobile number on the reference it will be the same mobile number they use to advertise the property. This way you can confirm at least that it is a real landlord.

– Ask for a bank statement as part of your referencing process to see if the tenant is able to afford the rent in line with salary or bank balance.

– Insist on a standing order being set up, you can find all blank banks standing orders on the banks website in PDF format, which you can print and bring along to a tenancy sign up.

– Fill it out and drop it to the bank personally or post it (a standing order for a particular bank can be dropped into any branch which will set it up on the banking system).

Now just watch the money coming into your account.

Beware that a standing order may not reach you on the same day as it is due. If your tenant banks with a different bank than you do, it may take up to 3 working days to reach you. To solve this problem, insist that the payment date on the standing order is set accordingly if it needs to reach you on its due date.

What if your tenant(s) have not rented before?

Well is it worth the risk? Are they the only interested party? Why is that?

Well these are the questions you need to ask yourself, don’t just assume because they come across as nice people that they will be good tenants. If the only tenants interested in your property don’t have a previous landlord reference is it worth the risk? Why are they the only interested party? Well it could be for a number of reasons;

–The property could be overpriced and the only tenants that are interested are interested because they can’t find anybody else to take a risk on them. Look at the market in your area, view photos online and be honest with yourself. Is your property to the same spec? If not, stop wasting time and money and adjust the price to what the market will pay.

-If your property is something that needs refurbishment, DO IT. It will pay off in the long run. You would be amazed at what a couple of months rent can do to a property and it could save you all the hassle in the long run by placing bad tenants into a property that good tenants wouldn’t touch.

If you go with a tenant who has no previous references, look for a guarantor letter to give more protection if something goes wrong. Otherwise, try getting a higher deposit as a way of good faith.

Tenant chosen

Hopefully your reference checking and selection of tenants will ensure all you have to do is watch the rent coming in.

Managing your rental payments

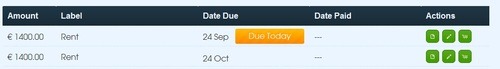

Keeping a eye on due rents

This is the most important part of being a property manager or a landlord insuring the rent is coming in on time every month. Just because a tenant pays the rent on time every month for 9 months straight it doesn’t mean month 10 is going to be on time or paid at all.

Case study:

I recently spoke with a landlord who had a great tenant in place for the previous 18 months, the rent was on time every month and the landlord stopped keeping his eye on his bank account. This landlord got complacent and too comfortable with his tenant and rent coming on time. When the landlord checked his account there was 5 months rent missing. I mean come on! Even though the landlord only has one property, being a landlord is a business. I mean, if he was a shopkeeper he wouldn’t leave the store unmanned with the day’s takings in the till. Being a landlord or a property manager is the same thing taking your eye off the ball can have terrible results. Luckily for this landlord the tenant placed in the property was a well-referenced tenant whose standing order ran out of payments. He paid in full the following week.

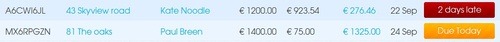

The best way for an agency and even single property landlords to oversee due rental payments is to use software that does the hard work for you; tracking and managing it.

So what to do if a tenant doesn’t pay his rent on time.

What to do when it starts.

Know your local law and your rights as a landlord.

In most countries, laws covering rented property give the advantage to a tenant. So don’t make any rash decisions, don’t go in all guns blazing putting all the tenant’s belongings on the street and changing the locks. This will most likely put you in a worse position than where you first started.

Illegal evictions at the time might seem right, but in the end can lead it large fines and even being forced by court order to allow your tenant reoccupy the property.

No one wants a tenant with a chip on their shoulder.

Check up on your local law and act accordingly

In Ireland for example, you first must issue a 14 days rent arrears notice and deliver in person to the tenant or by registered post. The Rentview application will create this legal document at the touch of a button. In my experience, this will show the tenants you won’t stand for any messing and normally pay up or give notice to quit the property before it goes further.

If the tenant fails to pay the rent after 14 days you must issue an eviction notice (the amount of time varies from 28 days if a tenant is occupying the house less than 6 months to 100+ days if they are tenants are occupying the house for years+

Note that these letters act as legal papers and as such need to be written in a correct format. One error on the document can set you back and you must start over with a new notice period to your tenants. So make sure if sending these yourself and not taking on the expense of a professional, that you do it correctly.

Listening to a tenant’s promise that the rent will be paid in full at the end of the week and taking the tenant’s word is not good enough. Back yourself up by sticking to the law and insuring you act upon late rent immediately.

You may not want to act to harshly on the first late rent payment as you may feel you will damage your relationship. This is a business, so treat it like one.

We hope this will help you in choosing the right tenant and managing your rental payments.