How to manage a property effectively

It is no secret in the Letting industry that property management is a staple source of reliable income – it is the “bread and butter” for agencies when lettings are slow. Although it is guaranteed income, it is also guaranteed hard work – but it is worth it.

Managing a property can be a time-consuming job depending on a few factors which may or may not be beyond your control. If you are a letting agent trusted with the responsibility of managing a property, it is vital that you do your job properly to ensure this steady stream of income and of course to make sure you get your renewal/re-let fee.

I have briefly outlined below the aspects of property management:

Managing rent payments

Rental payments should be monitored meticulously, any delay in receipt of rent should be acted on immediately, while keeping the landlord updated at all times. Failure to deal with rent arrears effectively makes your landlord lose confidence in your management service. For you as an agent, if the issue of rent arrears is not resolved from the get-go, it can lead to a pattern of late payments, which are a headache for you as the letting agent, having to regularly chase payments. For advice on this, check out our recent blog on How to collect rent

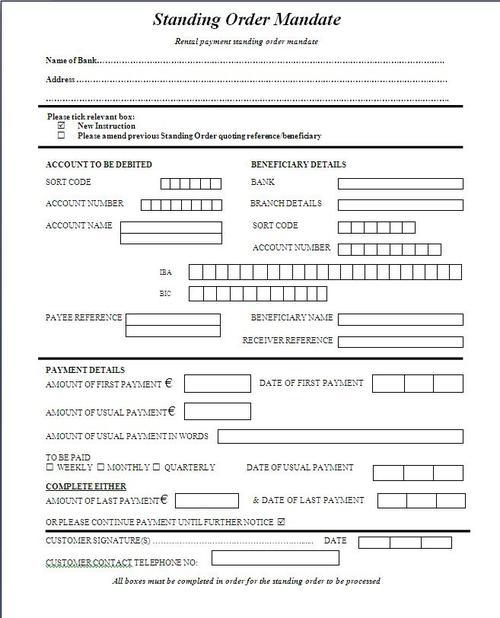

The most efficient method of managing rental payments is through standing order or direct debit. In my experience, if the standing order or direct debit is not set up initially, it leads to future problems and extra work/costs for the Letting Agency such as:

- Rent is not paid on time and the agent has to spend time chasing up the late payment.

- The rent is dropped into the agency office in cash, meaning the agency incurs cash lodgement bank charges, not to mention the additional time spent having to accept these cash payments and travelling to the bank to lodge them.

- Unreferenced bank lodgements – as Standing Orders and Direct Debits are always set up with a reference, it is easy to reconcile the rental payment to your landlord’s property. If the rent is lodged to your client rent account with no reference attached, it can mean an admin nightmare for your office administrator, as well creating a delay in paying your landlord. A delayed payment means an unhappy landlord!

- Disruption of the rent payment ecosystem; Tenant pays agency, agency collects fees and pays landlords rent minus manage fee.

Managing maintenance requests – down to the nitty gritty!

Being organised is the key to a successful and stress-free day in the life of a property manager. Maintenance covers many areas, from priority tasks such as leaks and broken showers etc. to non-emergency tasks such as changing a light bulb (yes its true!) or replacement of furniture.

To manage the various maintenance requests efficiently it is essential for the property manager to have a good Task Manager System in place. A Task Manager System that allows you to track your tasks to completion and alerts you to overdue tasks and also allows you to assign different tasks to property managers within your office is the most important tool in maintenance. Swift action and the correct solutions to property maintenance tasks ensures both landlord and tenant remain happy.

Managing your landlord’s accounts

If you are working in a mid-size or large letting agency, then dealing with the client’s accounts may not be your forté as most independent or franchise operators will have full time administrators to deal with the accounts side of things. Unfortunately for a start-up letting agency or a one-man-band property manager, this will mean many hats need to be worn and the main one from the operation of your agency is your client’s accounts.

Cash handling of rents and deposits

Having an effective method of collecting rents and deposit is extremely important as I mentioned above, standing order or direct debit as the most commonly used methods. Your agency may have a preference for a particular Tenancy deposit scheme when dealing with the tenants’ deposits and you can choose from 4 UK tenancy deposit schemes, Deposit protection , My deposits , Tenancy deposit scheme and the Capita TDP scheme with some of them offering a custodial or insurance-based scheme.

Automating your agency fees

Making sure your letting fees, managing fees or renewals fees are paid on time is the life blood of your agency and this is why it is important to manage the rental payments efficiently. When you have a good system in place automating your management fee deductions and reminders for renewals then is of the utmost importance for your cash flow.

Staying on top of your trades invoices

When managing a rental property, you must be prepared for all the pending property management issues which will happen. With this comes the invoice deductions for your tradespersons and being organised will save you stress in the long term.

I have seen first hand tradespersons’ invoices getting mislaid in the office, not paid by landlords because of discrepancies in their work or big delays because landlords didn’t receive them in time. What will happen in the long run in this case is that your trusted tradespersons will become disgruntled with your ability to pay them if you have a policy of only paying once funds are in.

To manage this effectively, request your tradespersons to email you a scanned or PDF copy of the invoice so you can send a copy immediately to your landlords or upload them to be deducted from the rent. Make sure that it is in your agreement with your landlord to make the necessary deductions, as some agencies have a limit on what work they can get done on properties without consulting their landlords.

Apartment management service charge

If you are managing a property for a landlord and the property is under the control of the property management company then you may be required to deduct the landlord’s service charge from the monthly rent. Keeping track of these deductions and allocating them to the landlord’s statement can be a time-consuming process and you should look to automating these deductions to save you time.

Non-resident landlord tax deductions

When you are a managing a property for a non-resident landlord, it is compulsory that you deduct the correct tax at the time of receiving the rent, not when paying it to the HMCR. For more information, check out this blog on the non-resident landlord scheme for the UK.

Regular property inspections:

It is good practice when managing a property that you inform the tenants of any pending inspections scheduled on the property. Most letting agencies will have a policy of doing 2-3 regular inspections on the property if the lease term is 12 months. If you highlight the inspection policy to your tenants when they sign the lease, then you have a greater chance the tenants won’t leave the property untidy.