Our tech start-up of the week is Rentview, a rent and property management cloud-based platform for estate and letting agencies to manage, build and retain their rental portfolios. It is also aiming to help tenants manage their monthly rental payments more efficiently.

Rentview was set up in Dublin in early 2010 and went into Beta with 10 agencies in July to test features and get feedback.

The duo behind Rentview are Andreas Riha and Colin Napper, both previous owners of a letting agency in Dublin.

“We learnt all the problems associated with having a lettings and management portfolio. We saw an opportunity to streamline the process by automating the estate and letting agent’s job as much as possible,” they told Siliconrepublic.com yesterday.

So how did the business get up and running? Firstly, Napper entered the DIT Hothouse programme in October 2010. He said he gained valuable knowledge about launching a business in the internet space.

“We applied much of that learning to developing our minimum viable product. We entered an agreement with our developers who developed the Rentview app as they loved the concept and we boot-strapped getting it off the ground with money from ourselves and personal loans.”

The Rentview team itself comprises Napper, who is CEO, Riha, director of sales and marketing, Kurt Funai, senior developer, and Cormac Nugent, marketing.

Helping hand

But have there been any entities that have helped Rentview along the way?

“We found the DIT Hothouse programme to be very beneficial and they provided incubation office space for free, which allowed us to develop the Rentview app. We also got an innovation voucher that facilitated DCU to help us with market research. And we are currently engaged with Enterprise Ireland with regard to launching Rentview for the UK market,” explained Riha yesterday.

Dublin Beta

Recently, Rentview showcased its app at Dublin Beta.

“We met some very cool people, most of them tech heads who were tenants and we explained the benefits of tenants using Rentview. All of them saw the value of being on Rentview from a tenant’s perspective,” explained Napper.

“At Dublin Beta, there was a People’s Choice award. Through this, attendees got €3,000 in the value of poker chips as investment chips to give out to the start-up they liked. We came third out of 14 start-ups,” explained Riha.

But where is Rentview at right now in terms of its commercialisation strategy?

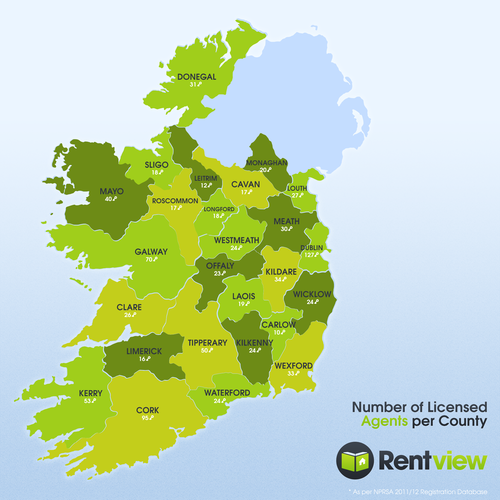

“The Rentview current product is ready for the Irish market and we are putting together a marketing campaign for January 2012. We want to ramp up sales to agencies in Ireland. Our plan is to develop the product for the UK market, which is 10 times bigger and the rental industry is more regulated there. So the UK is out next market target,” said Napper.

So what, exactly, is the advantage of people using this cloud-based product, rather than going down the traditional property-letting or renting route?

Riha explained that a Rentview customer is an agency which subscribes to Rentview via a software-as-a-service (SAAS) model. In turn, he said such an agency will get many benefits, including saving time, automating paperwork, streamlining processes and giving better customer service to landlords and tenants.

Lately, we have been hearing a lot in property circles that it is a renter’s marketplace right now, with the balance having shifted from being a landlords’ paradise.

Napper points to how the ESRI encouraged young people to rent this week.

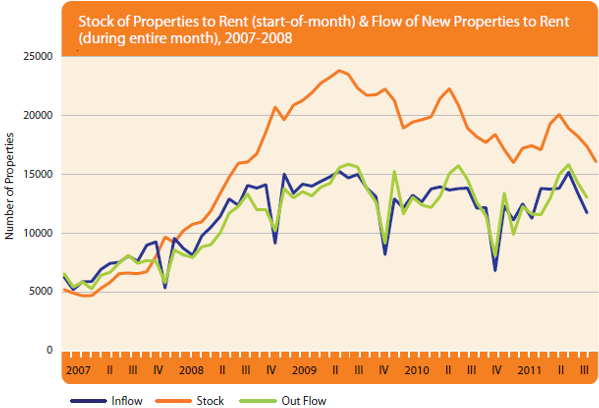

“The supply of property in July 2009 in Dublin was 8,300 and is currently at 3,700. Rents are rising again because of lack of supply in some areas and landlords are getting hit with more taxes and regulations.

“Good tenants are a valuable commodity in the rental market and we plan on developing a renters’ referencing or accredited system for tenants who pay on time and leave properties in good condition. This minimises the risk for the agency and landlord and makes the job of an agency easier,” he said.

Advice for self-starters

And finally, what advice would Napper and Riha give to other people thinking of venturing out on their own?

They recommend reading The Lean Startup by Eric Ries before developing a new product.

“When we had the idea for Rentview it was way more detailed than what we currently have and would have cost us three times more to develop but we were advised to build the ‘minimum viable product’. Secondly, if you can get on a platform like the DIT Hothouse programme, or the NDRC LaunchPad/Inventorium, these people have great insight into new ventures. And, lastly, get out and and talk to people. Don’t be afraid. It’s only an idea you have and there are many of them,” added Riha and Napper.

Carmel Doyle  |

|