The Non-resident landlord scheme in the UK

The Non-resident Landlord Scheme is something you’ll need to be aware of if you are dealing with non-resident landlord accounts in the UK. There is great potential for letting agents to increase their portfolio with non-resident landlords, however a working knowledge of the legalities is needed. Below is a quick summary of some of the key points about this scheme.

What is the non-resident landlord scheme?

A simple definition:

According to Revenue and Customs in the UK, “The Non-resident Landlord (NRL) Scheme is a scheme for taxing the UK rental income of persons whose ‘usual place of abode’ is outside the UK”

A more detailed definition:

According to Revenue and Customs in the UK: “The Non-Resident Landlord’s (NRL) Scheme is a scheme for taxing the UK rental income of non-resident landlords. The scheme requires UK letting agents to deduct basic rate tax from any rent they collect for non-resident landlords. When working out the amount to tax, the letting agent can take off deductible expenses. Letting agents and/or tenants don’t have to deduct tax if HM Revenue & Customs (HMRC) tells them not to. HMRC will tell an agent/tenant not to deduct tax if non-resident landlords have successfully applied for approval to receive rents with no tax deducted. But even though the rent may be paid with no tax deducted, it remains liable to UK tax. So non-resident landlords must include it in any tax return HMRC sends them.”

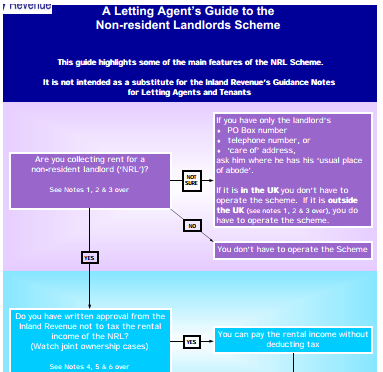

Letting agent’s obligations regarding the non-resident landlord scheme

“Letting agents of a non-resident landlord must:

• deduct tax from the landlord’s UK rental income; and

• pay the tax to HMRC’s Accounts Office, Shipley.”

Further details

Revenue and Customs provide a guide to the scheme. Guide notes can be found here. Key points from the guide are to:

- Deduct tax at the basic rate (% for 2013) from the rent, after first taking off any deductible expenses.

- Calculate the tax at the time you receive the rent, not when you pay it to the landlord.

- Pay the tax to the Inland Revenue’s Accounts Office at Cumbernauld using a form NRLQ within 30 days of the end of the quarter it relates to. The quarters end on 30 June, 30 September, 31 December and 31 March.

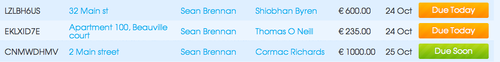

Letting agents must include the following details on the return form:

• the total amount of tax due in respect of all their non-resident landlords for that quarter; or

• where there is no tax due in the quarter but the letting agent is due a repayment, the amount of the repayment claimed. Also “Letting agents who have to operate the NRL Scheme must register with HMRC PT International within 30 days of the date on which they are first required to operate the scheme.”

Letting agents’ obligations

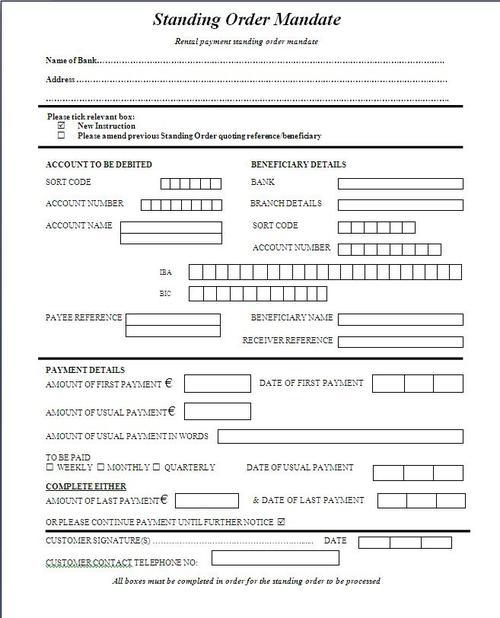

Letting agents who have to operate the Non-resident Landlords (NRL) Scheme must:

• register with PTI;

• account quarterly for any tax to HMRC Accounts Office, Shipley;

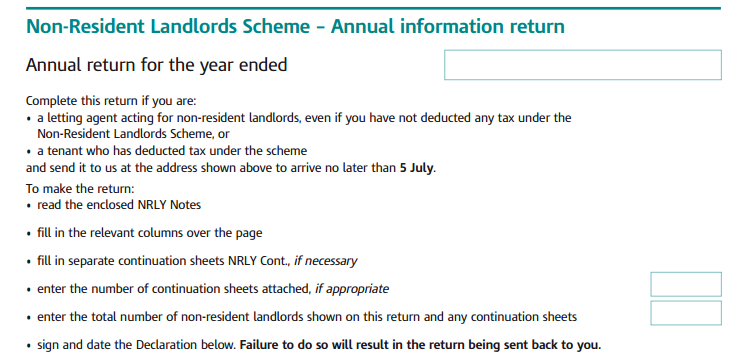

• complete an annual information return;

• where they are required to account for tax, provide their non-resident landlords with a certificate each year; and

• keep sufficient records to show that they have complied with the requirements of the Scheme.”

Also of note

Applications by non-resident landlords for approval to receive rent with no tax deducted “Non-resident landlords who are eligible can apply at any time for approval to receive their UK rental income with no tax deducted. This includes applying before they have left the UK or before the letting has started.”

Conditions

Conditions for applying to HMRC for approval to receive rental income with no tax deducted Non-resident landlords can apply to receive their rent with no tax deducted on the basis that either:

- their UK tax affairs are up to date

- they have not had any UK tax obligations before they applied

- they do not expect to be liable to UK Income Tax for the year in which they apply

- they are not liable to pay UK tax because they are sovereign immunes (these are generally foreign Heads of State, Governments or Government departments)

Useful links regarding the non-resident landlord scheme:

For landlords – FAQ

Important information on tax returns – relevant for those dealing with the non-resident landlord scheme.