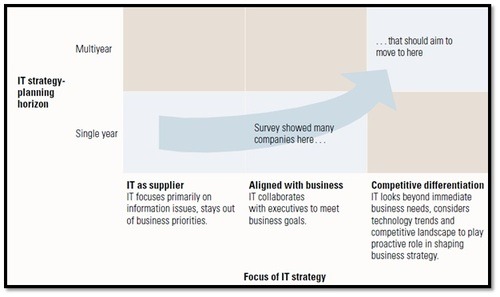

Strategic alignment refers to the closeness of the relationship between company CEO’s or senior management and Information systems managers, or those workers heavily involved with the use of technology and software in the work place. Aligning the information system’s purpose and direction with the overall direction of the firm is a vital for long-term success.

The purpose of this blog is to help agencies and other companies alike to understand the process of aligning the needs of the organisation. After a year of learning about the role of information systems in organisations today, one thing was clear to me in my studies; it’s all about the planning.

Opportunities come and go fast, so it is important for all management to sit down and plan the role of information systems in the organisation. There are some key PEOPLE that an organisation needs to look at first; general managers, functional managers and the end-user are all important when making a decision on the use of information systems. For example, if you are debating whether to purchase property management software for your agency, it’s important to discuss the potential use of the software with your functional staff members and the end-user who is your customer, be it landlord or tenant.

To help align the information systems goals with business goals there are a few key questions that a general manager and firm can ask themselves. Gabriel Piccolli, the author of Information systems for Managers, Texts and Cases brings us the five key questions.

1-How much should we spend on IT?

A simple question that forces senior execs to discuss and decide what they are willing to spend on the role of information systems in the organisation, it helps if the agency know their budget before they go to the market looking for a property management solution.

2-Which business process should receive the €€€?

Which business processes are important to the firm that need some IT investment? I would assume activities such as website maintenance and management of customers would place highly here. Again it’s good to establish these things before making your investment.

3-How good do our IT services really need to be?

This question forces senior execs to make a conscious decision about the degree of service the firm needs and what they are willing to pay for. A smaller agency may only require a simple and low complex software system for certain business activities while the multi branch agencies may require a bigger and more comprehensive system.

4-What security and privacy risks will we accept?

Obviously this is something an organisation needs to discuss before investing in an information system and it is a hot topic at the moment with Google who I like to call ‘the ruler of the internet’ catching some negative PR for their new policies on the storage of customer data. For agencies looking to acquire software and align its use with business goals, you must ensure your data will be safe and retrievable when purchasing a system. Most software providers will state weather data can be obtained at the end of use.

5-Who do we blame if it all goes wrong?

Execs must clearly identify and assign responsibility for the information systems in the firm. This is helpful in assessing problems with the use of the software, such as the system not meeting expectations of the general managers. To put this into context, if you were to purchase a Rentview package for your agency you may assign work to your functional and general staff. In this case the general manger or agency owner may be responsible for setting up the different user accounts of each of his functional staff (the property managers), while a functional manager such as a senior letting agent may be given the responsibility of setting up accounts for the agency clients; both landlords and tenants.

That’s it for today, the next post relating to information systems will look at the first stages of the planning process. Please feel free to comment and discuss the post below.

by Rentview