So you want to streamline the rent collection service you are offering within your agency?

Having administration problems collecting rental payments from your tenants? Are tenants dropping by your office and paying cash in rent or worse still, are you dropping by the late properties and collecting rental payments from tenants? Administration and time-consuming nightmare!

Are you aware that as of July 6th 2012 the Property Services (Regulation) Act 2011 states that your client’s account needs to be totally transparent and audited at the year’s end? Have you the correct paper trail put in place to track everything?

So apart from the headaches in collecting rental payments in cash and lodged by tenants in cash, there is also a significant cost in doing this. This is a great opportunity for you to streamline the rental management side of your business.

There are a number of steps needed to be taken in order to streamline the rent collection service:

1. Client’s Rental account. This is a must and the very first step which needs to be taken. If you do not have a rental client’s account, get in contact with your bank manager and set one up. This is quite an easy process and your bank will be happy to facilitate this.

2. Banking online. If you do not use banking online yet, get it set up immediately and have the ability to access the rental client’s account.

3. Set up a launch date to have your tenants pay into your rental client account. If you have a number of tenants that pay directly into your office or lodge in cash to your rental account who are mid-lease, inform them of the changes being launched. Set a realistic launch date. Say perhaps 6 weeks away. This should give ample time for tenants to set up a standing order from their bank accounts to yours. This may not be to every tenant’s liking, but it’s essential for your business. Not only does it cost you when you or tenants lodge in cash(typically .5% of a lodgement is a charge) but it’s unsafe and an administration nightmare.

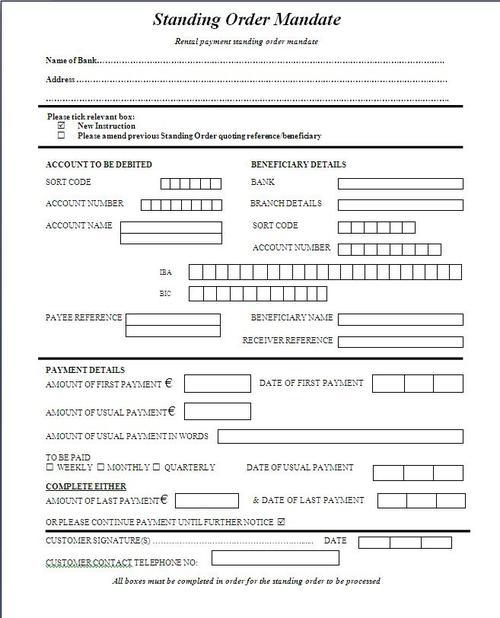

4. Issue your tenants with a standing order and ensure they return it to you signed and referenced. The standing order should have a start date (at the latest their second next payment due) and a end date (the end date should be the 11 month of the lease i.e if the lease if up on the 1st of September then the last rental payment should be the 1st of August). A standing order can run without an end date also. It is essential to have the rental payment referenced. The receivers reference is what needs to be filled out on the standing order so once the payment reaches your account you know what it is for. Rentview issue a lease code for each lease you are managing. The lease code is an 8 digit code mixed of letters and numbers (which will never be duplicated). You may also want to use the first line of address but this may be duplicated in time. Lastly, submit the standing order with the tenant’s bank. This can be done by post or by handing it into a branch.

You can fill out a standing order form for a tenant and get the forms from a branch of a bank or online. Here is an example of a Standing order form from AIB. Remember you need to get the tenant to sign this.

You may also use a white labelled standing order form as seen here.

5. Setting up new properties with a rental management collection. This is very similar to above. Typically the first monthly payment is paid up front with the deposit on signing of the lease. If this is the case, the first payment collected via the standing order would be for the 2nd rental payment (if the lease was signed on the 1st of July the 1st payment collected via standing order shall be the 1st of august)

6. Monitoring the payments. For effective rental management, the client’s account should be checked every day a rental payment is due or if payments are outstanding. Once a payment is made, the rent should be forwarded to your landlord’s rent account. This should be preferably done electronically through online banking (more efficient and it costs less than issuing a cheque). Any deductions and management fees should be withheld. All in-house fees should be transferred weekly to the business account. It is good practice to clear the clients rental account weekly to “0” or just the holding of rental deposits. In most cases, a second client’s deposit account should be set up to hold these.

7. Rental payment receipts. As payments are received electronically, a rent receipt should be issued to the tenant in line with the tenancies act. Through Rentview, as you process payments as ‘received’, your tenant is automatically sent a rent receipt via email.

8. Non-paying tenants. If a tenant fails to pay on time, the tenant should be contacted and after a grace period of say 3 working days, a rent arrears notice should be issued. This is best industry practice and should be enough of a deterrent for the tenant to pay on time in the future. The longer a tenant does not pay and no rent arrears notice is issued, the longer the agency is exposing the landlord to potential losses. The Rentview system will automatically generate the rent arrears notice in line with the Tenancies Act 2004.

9. Landlord’s accounts & end of year statement. A copy of the landlord’s accounts which shows all deductions and invoices should be kept for the landlord at all times. Through Rentview your landlord will be able to access their accounts at any stage, once given access by your agency. If you do not wish to give landlords access, the accounts can be printed off at any stage.

As always we would love to hear your feedback on this topic. Is there a topic you would like discussed?

by Andreas Riha